What Does Paul B Insurance Mean?

Wiki Article

The Paul B Insurance Ideas

Table of ContentsThe Only Guide for Paul B InsuranceThe Definitive Guide to Paul B InsuranceNot known Incorrect Statements About Paul B Insurance Things about Paul B InsuranceEverything about Paul B InsuranceAn Unbiased View of Paul B Insurance

With home insurance policy, for circumstances, you might have a replacement expense or actual cash money value plan. You need to constantly ask how claims are paid and what the insurance claims process will certainly be.

The thought is that the cash paid in insurance claims with time will be less than the total costs accumulated. You might feel like you're tossing money gone if you never submit an insurance claim, but having piece of mind that you're covered in case you do endure a considerable loss, can be worth its weight in gold.

Not known Facts About Paul B Insurance

Picture you pay $500 a year to insure your $200,000 residence. You have one decade of making payments, and also you've made no claims. That comes out to $500 times ten years. This indicates you have actually paid $5,000 for home insurance. You start to wonder why you are paying so much for absolutely nothing.Since insurance coverage is based on spreading out the threat amongst several people, it is the pooled cash of all individuals paying for it that permits the business to develop possessions and also cover claims when they take place. Insurance policy is a company. Although it would certainly be great for the business to just leave prices at the very same degree all the time, the fact is that they need to make adequate cash to cover all the prospective insurance claims their policyholders may make.

how much they entered costs, they should change their prices to earn money. Underwriting changes and rate rises or declines are based on outcomes the insurance provider had in previous years. Depending upon what business you purchase it from, you might be dealing with a restricted agent. They offer insurance from just one company.

Paul B Insurance for Beginners

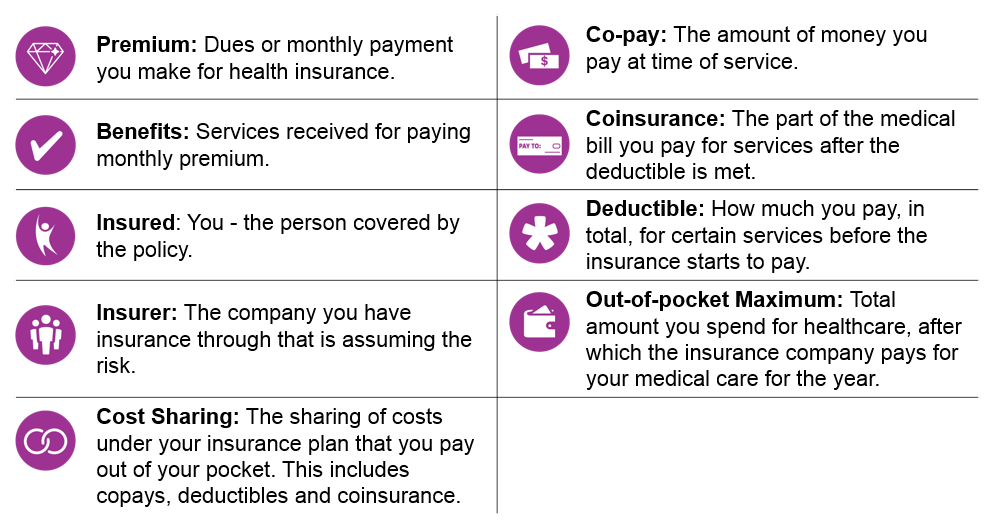

The frontline individuals you deal with when you buy your insurance are the agents as well as brokers that stand for the insurance policy company. They a familiar with that firm's products or offerings, but can not speak towards various other companies' plans, rates, or product offerings.They will have access to greater than one firm as well as must recognize concerning the variety of items offered by all the companies they represent. There are a couple of vital inquiries you can ask on your own that could aid you decide what type of protection you require. Just how much threat or loss of cash can you presume on your own? Do you have the cash to cover your costs or financial obligations if you have a mishap? What concerning if your residence or cars and truck is messed up? Do you have the cost savings to cover you if you can not function due to a crash or illness? Can you afford higher deductibles in order to minimize your prices? Do you have unique needs in your life that require additional protection? What issues you most? Plans can be tailored to your needs and also identify what you are most concerned regarding protecting.

The insurance you need varies based on where you go to in your life, what sort of properties you have, as well as what your long-term objectives as well as responsibilities are. That's why it is essential to make the effort to review what you want out of your plan with your representative.

All about Paul B Insurance

If you take out a finance to purchase an automobile, and afterwards something occurs to the car, void insurance policy will certainly settle any portion of your finance that conventional automobile insurance coverage doesn't cover. Some lending institutions need their debtors to lug void insurance coverage.The primary function of life insurance policy is to provide cash anonymous for your recipients when you pass away. Yet exactly how you die can figure out whether the insurance company pays the fatality advantage. Depending upon the kind of plan you have, life insurance policy can cover: Natural fatalities. Dying from a heart Full Report attack, disease or old age are examples of natural fatalities.

Life insurance covers the life of the insured individual. The insurance policy holder, that can be a various person or entity from the guaranteed, pays premiums to an insurance policy business. In return, the insurance company pays an amount of cash to the recipients provided on the policy. Term life insurance policy covers you for an amount of time chosen at purchase, such as 10, 20 or 30 years.

Paul B Insurance for Dummies

If you do not die during that time, no one gets paid. Term life is prominent due to the fact that it supplies large payouts at a lower price than irreversible life. It also offers insurance coverage for an established variety of years. There are some variants of typical term life insurance policy plans. Convertible plans enable you to transform them to irreversible life policies at a higher costs, enabling for longer and also possibly much read this post here more adaptable protection.Permanent life insurance coverage plans develop cash money value as they age. The money worth of whole life insurance coverage policies expands at a set price, while the cash value within global policies can vary.

$500,000 of whole life protection for a healthy 30-year-old woman expenses around $4,015 every year, on average. That exact same degree of protection with a 20-year term life policy would set you back an average of regarding $188 each year, according to Quotacy, a broker agent company.

Some Known Facts About Paul B Insurance.

Report this wiki page